- #Managerial accounting break even point formula how to

- #Managerial accounting break even point formula full

- #Managerial accounting break even point formula plus

Sales revenue ($) required to earn target profit = (Fixed cost + Target profit) ÷ CS RatioĪ profit-volume (PV) chart is a graphic that shows the earnings (or losses) of a company in relation to its volume of sales. Sales volume (units) required to earn target profit = (Fixed cost + Target profit) ÷ Contribution per unit The margin of safety indicates by how much sales may fall before the business starts incurring losses. (5,000 units x 20 per unit) Less: variable costs.

#Managerial accounting break even point formula plus

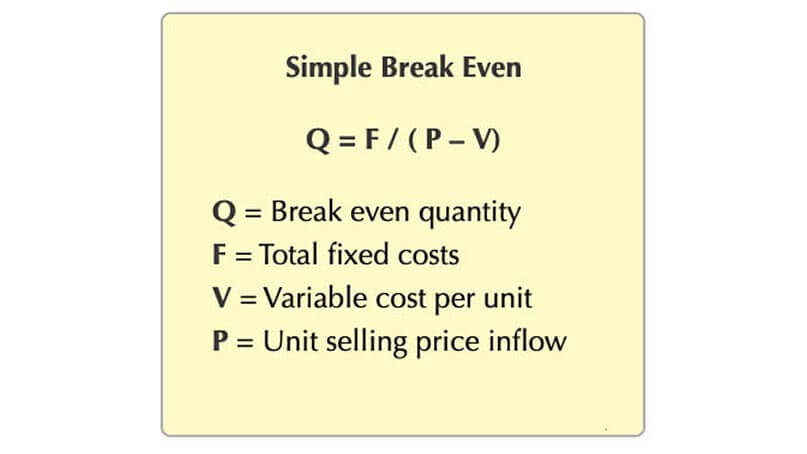

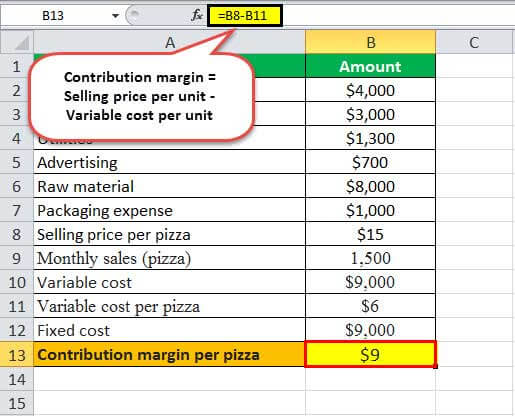

At this level of sales, fixed costs plus variable costs equal sales revenue, as shown here: Revenue. = Fixed cost ÷ (Selling price- Total variable cost per unit) × Selling price The break-even volume of sales is 100,000 (can also be calculated as break even point in units 5,000 units x sales price 20 per unit). = Fixed cost ÷ Contribution per unit × Selling price = Fixed cost ÷ (Selling price- Total variable cost per unit) The Break-even point can be calculated in units or dollars At this point, total cost is equal to total revenue and contribution is equal to fixed cost. The breakeven point is the point at which there is neither profit nor loss. Marginal profit and loss statement (IN TOTAL) A business that makes sales providing a very high gross margin and. = Contribution per unit ÷ selling price × 100 Operating leverage is a measurement of the degree to which a firm or project incurs a combination of fixed and variable costs. As a reminder, use the following formula to find your break-even point in units: Fixed Costs / (Sales Price Per Unit Variable Costs Per Unit) Say you own a toy store and want to find your break-even point in units. Whatever be the level of output the CS ratio always remains the same. Break-even point in units is the number of goods you need to sell to reach your break-even point. The C/S ratio is a measure of how much contribution is earned from each US$1 of sales. It's called also profit/volume ratio or marginal ratio. The CS ratio is one of the most important tools used in profit management for studying the profitability of a business. NOTE: Whatever be the level of output contribution per unit always remain the same. There are two break-even calculations you can use to determine when your business will become profitable: a break-even formula that uses units sold and a break. = Selling price – (DM/unit + DL/unit + VO/unit) = Selling price – Variable costs per unit = Sales – (Direct materials + direct labour + variable overheads) Contribution gives an idea of how much money is available to 'contribute' towards paying the overheads of the organisation. In economics & business, specifically cost accounting, the break-even point (BEP) is the point at which cost or expenses and revenue are equal: there is no net loss or gain, and one has 'broken even'. The marginal cost of an item is its variable cost. The breakeven analysis is especially useful when youre developing a pricing strategy, either as part of a marketing plan or a business plan.

#Managerial accounting break even point formula full

The BEP calculator first calculates the break-even point in sales by using the basic BEP formula and then divides the BEP sales by the sale price per unit to find the BEP in units.Marginal costing is the cost accounting system in which variable costs are charged to cost units and fixed costs of the period are written off in full against contribution. This output tells the number of units to be sold to break-even. This output tells the dollar sales needed to break-even. The price at which a single unit is sold in the market.

Fill this field with the variable expenses that you incur to manufacture and sell a single unit of product. Variable expenses vary with a change in producing and selling activities. For example if your monthly and annual fixed expenses are $500 and $6,000 respectively and you are calculating the break-even point for the next month, you need to use the amount of $500 as the fixed expenses. You need to enter in this field the total fixed expenses for the period for which you are calculating break-even point.

These are expenses that do not change with production of units or provision of services to customers.

#Managerial accounting break even point formula how to

How to use break-even point calculator Inputs required

0 kommentar(er)

0 kommentar(er)